It’s earnings week. So far we have seen Russel 2000 claw back 4%. In the meanwhile this happened:

- $MSFT down 7% plus

- $GOOG down 10%

- $META down a jaw dropping 25%

I mean we all knew Meta was going down, but jeez.

At some point during the 2008 crash right before the final, and largest, leg down, we saw small caps running while the big caps started to fall.

One by one.

All of this in today’s market analysis.

And by the way, this is still relevant, today more than ever.

Oct 25, 2022

The big algo pump continues with basically everything in gain regardless of the sector. Gold is not participating in the run, calling bluff on the apparent retreat of the US Dollar.

You know what is staging a comeback instead? Crude oil. Told ya. Massive 3.15% swing up from the 83 floor. Massive upside rejection today. This establishes a possible saucer formation.

Here it comes the danger zone: the more energy goes up, the uglier inflation numbers will be 3 months down the line. In turn, the FED will need to become even more hawkish. Forget about 75 basis points.

But hey, the algos are discounting a FED dovish turn right now, so it’s risk-on baby. Up we go!

$MSFT Earnings

Let’s start with the most mature stock of the Tech landscape, probably the one with the best fundamentals right now.

Operating expenses are up 15%.

Revenues should have been 16%.

The damage being done by the strong US Dollar is about 5% (of decreases in revenues, and increase in costs).

The main theme here is Azure. Azure numbers are bad in terms of revenue. Not only income has been decimated by the base currency, but growth slowed down to 35% YoY.

This not only signals difficulties ahead in order to rake in more gains, but also is a leading indicator that the tech landscape is deteriorating rapidly.

$MSFT reacted with a drop of about 7%. It’s bad.

Earning for $GOOG (of $GOOGL if you happen to wear a monocle)

Google went down 10%

There isn’t much more to say.

The revenue model for the company is aging quickly, this isn’t exactly news. The problem here is that $GOOG is still grossly overvalued and has a lot to shed. Probably a 10% total value drop helped in that direction.

The latest high-growth cash cow that is Youtube backpedaled BIG TIME and officially marked its transition to being an after-peak asset. And we all know why: Youtube sucks. It’s not the ads per se, but the policy driving the platform to shove uninteresting vanilla videos down the throat of the viewers in order to make the ad payers happy.

This is a problem: the platform is punishing interesting content creators which find it more difficult adhering to countless and unwritten rules, random AI strikes and random copyright strikes. It’s demotivating for them and for their viewers.

Youtube is becoming a cable service. It sucks now.

The problem is that Google doesn’t have a new cash cow down the pipeline. It’s still a great company, mind you, but it’s starting to look less and less like a growth stock.

Oct 26, 2022

Oh. What a day, what a day!

Institutions are piling to throw money at the market, BIG. Much of the buying happens right at the open, then they leave to do other stuff at the desk. Probably jerking off. It’s not their money after all.

Both US 2-year note yields and US Dollar dropped a massive 1% plus. Google and Microsoft being down, not a matter of concern at all. Who cares, here’s more money.

VIX down 3.8% now safely in the 25-30 area looking for support, which is a strong bullish signal.

But gold still isn’t participating, closing flat-ish for the day. Remember, Gold is the mature asset: it’s calling bullshit on the rally.

Oh, and Crude Oil is up 4.5% too!

Oil is confirming a large saucer formation from which is ready to take off again. Hear the sweet sound of peak inflation, right?

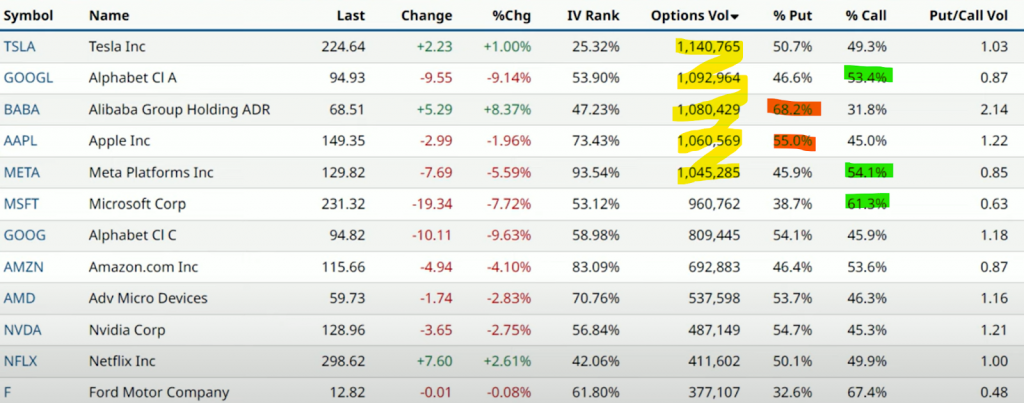

Options

Finally some volumes! $TSLA is undergoing a mini gamma squeeze, expires this Friday.

Google, Microsoft and Meta cratered and someone is buying short-term call for a rebound. It’s going to be a one-night stand and then down again.

$AAPL is alarming. Earnings are due tomorrow after the close.

Market behavior

Overall bullish. Nasdaq down 2% plus because of $MSFT and $GOOG, attempts to claw back to the resistance and it’s rejected. Closes overall where it opened. Notice that despite the tech big caps being down, everything else is up.

So far the market has ignored the drops in mega cap stocks. My hunch is on the market making peace with these losses in the near future, to the downside of course.

But so far the larger stocks bombing one by one hasn’t been registered as a legitimate concern. Let’s see how long this lunacy goes on.

Remember: tomorrow after the close, it’s going to be $AAPL time. The market goes where Apple goes.

And Apple is starting to look desperate:

- 30% racket fees on any transaction carried out via iOS devices

- 16” iPads coming

- Bogus production policies for the M2 silicon.

Weird things are happening to say the least. Either way it’s going to be fun.

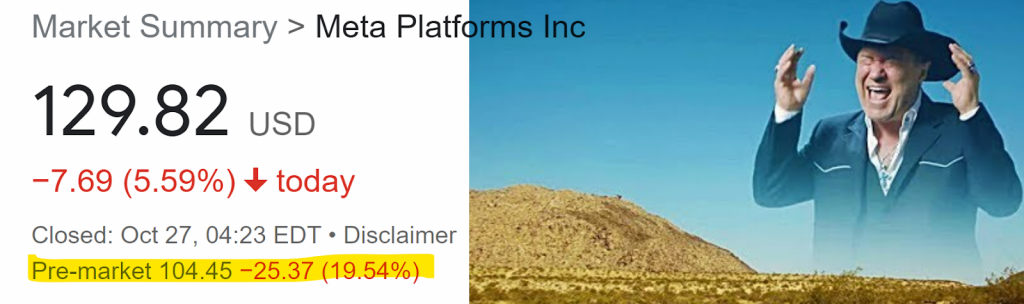

$META

Oh you want to know about that?

Here’s the kicker:

Now hear me out.

Twenty five

percent

freaking drop.

What the f was that?

It’s the Metaverse lunacy, that’s what it was. The most expensive vaporware gamble in history.

And I mean, ok, I guess Mark Zucchino isn’t the only one that has read Snow Crash back in the ‘90s and fell in love with it. But damn, that was 3 decades ago.

A lot has been said and done in the fields of VR, AI, gaming and tokenomics. We today know for sure that some approaches do work and are economically viable, while others don’t.

Remember Second Life? Well it was a massive bubble before the 2008 crash. Guess what? It didn’t work out.

There is absolutely no reason why the Metaverse should be any different.

It isn’t fun, it isn’t innovative in any way. It doesn’t bring anything new to the field. It’s now becoming the giant money sink that is dragging the whole company down.

Mark has obtained a cult-like status in the company, and has cleared the board of any alternative personality and views. He has put himself in a position where absolutely no one can say “no, this is a bad idea” and he now keeps raving about the Metaverse thing.

Right now, and until something changes, Meta is a company that has long since seen its peak, has absolutely nothing new down the pipeline, has managed to shit repeatedly on its users and it’s burning cash like a drunken sailor with absolutely nothing of value to show for it.

And I wanted to own puts ahead of earnings but damn, those where incredibly expensive. We are talking 9$ a piece for 3-days expiration. I guess I’ve learned again that good bets don’t come cheap.

Closing remarks

Remember, $AAPL earnings tomorrow after the close. And then the PCE numbers. Either of those can stop the rally instantaneously. Let’s see what happens.

Trade scratchpad

$NFLX starting to be overbought. Ready for a short?

Long $XHB entered 20%. In loss.

Long $MPC and $VLO in place 20%. In gain. Looking for a pullback to add.