Greetings! Long time no see huh?

What did we do whilst the insanity trumped the markets, during the last a couple of months? Of course we’ve been hiding, under a rock, for it to end.

If you recall, in November 2022 I wrote a specific closing paragraph, about what was probably going to happen from that point on.

Allow me to quote what I said in that occasion:

Retail investors aren’t joining the pump scheme. […]

They are dumping positions that are in the red, as an opportunity to get out with smaller losses.

They are betting against the market via put options, or via inverse index ETF (which has basically the same effect)

You see this is a problem, because the market will ultimately, always, always take over the dumb money. And if the dumb money’s bets are for a market decline, then the only way the market makers have to take their money is run into all of their stops, pushing the market higher.

Save for any news factor hindering it, this is going to be the Mother of All Bear Market Rallies.

Sacro, Nov 2022

This is almost verbatim how events ended up unrolling:

- Short covering took place. Funds protected their exits by hedging with call options, as per standard practice.

- This induces underlying purchases, because the market makers, who are liable for the bulk of those call contracts, have to ensure they stay “delta neutral” (I.e: they don’t want to end up holding the bag)

- This pushes the market higher. A number of technical signals are triggered (prices climbing above their MM200, making golden crosses, etc) and algorithms and momentum funds start buying, causing a rally that causes even more short covering. In the crossfire, dumb money is caught by surprise, and forced to close at a loss.

- The rally feeds on itself prompting more and more participants to switch to bullish positions, in a newfound enthusiasm, sucking money in.

All of this has been happening while the fundamentals of the economic tissue continued to deteriorate. This rally is a nothing-burger, fuelled only by media hype and optimism.

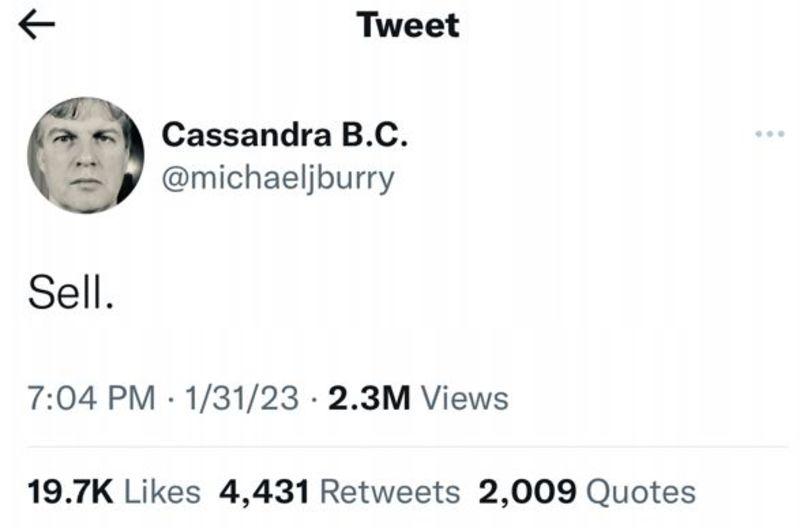

We have been warned by none other than Michael Burry, which briefly abandoned his usual cryptic means of communicating in what proved to be yet another spectacular example of correct macro views with bad market timing:

… and of course the market reacted from that point with a vigorous, and final, leg-up. Burry got ridiculed, even if we all knew he is 100% right and his vindication will come later.

We know S&P 500 doesn’t belong above 4000. By its current FUNDAMENTAL projection, it should price at 3200 if not below.

Macro updates

In essence, the first two months of 2023 were a pointless exercise. Market went up, the media focused heavily on any little piece of news in order to fuel the bullish sentiment. More than anything, the Bad News is Good News market bias served as the definitive confirmation that this was, indeed, a bear market rally, and that the market market bottom has not been reached yet.

All of that happened while in reality the worst possible outcome of the macroeconomic space quickly materialized.

We have high inflation that doesn’t respond promptly to interest rate hikes, coupled with high leverage and high debt accrued by financial entities. Both factors are ensuring that the economy at large will be decimated.

Welcome to Stagflation, the natural consequence of high inflation:

- US household debt kept climbing because consumers are forced to resort to credit cards to make ends meet

- Mortgage delinquencies started to creep up because mortgage rates aren’t serviceable by an increasing amount of households

- The amount of home buyers that bought at the market top and is now under water increases, as market valuations nosedive

- The commercial real estate bubble popped

- After months and months of apparent resiliency, unemployment finally shows up in the numbers (And this is a heavily lagging economic indicator, so it’s just the tip of the iceberg)

- Past inflation numbers have been revised to show that the disinflation process never really materialized and more rate hikes are necessary.

We knew all of that. We were prepared. There wasn’t really anything new to write on this blog so far.

Systemic risk

But yesterday we got a new piece of news: here comes a hidden systemic risk.

It turns out small US banks have a liquidity problem. Why? Because they have been allowed more lenient regulations and, in turn, they have on their books a lot of crap that was, by regulation, allowed to show up with breakeven maturity values instead of unrealized losses.

What does this mean?

Banks are holding bags in US government and corporate bonds, and commercial mortgage backed securities. All assets that were hit particularly hard by the high interest rate environment the FED is forced to create and maintain.

This poses a big, big systemic threat to the system, because an unknown number of banks might simply not have the means to match their liquidity requirements. They can’t sell their assets at a loss either, and thus their books that on face value were very liquid are now, with no surprise to me at all, not liquid at all.

If this reminds you, at a distance and very slightly of “bank runs” then you are right. Because it does.

So, suddenly, bad news is no good news anymore. The market actually went down with the US Dollar, all while the safety of US bonds continued to appreciate through the day. This break of an established strong correlation between USD, equities and bonds, signals the start of a new market cycle.

What is coming to the surface now is very concerning. We don’t have a clear view of the ripple effects.

Is this the next domino tile? There’s no way of knowing.

But I have no doubts: now we go down.

RELOAD ALL SHORTS!!