Table of Contents

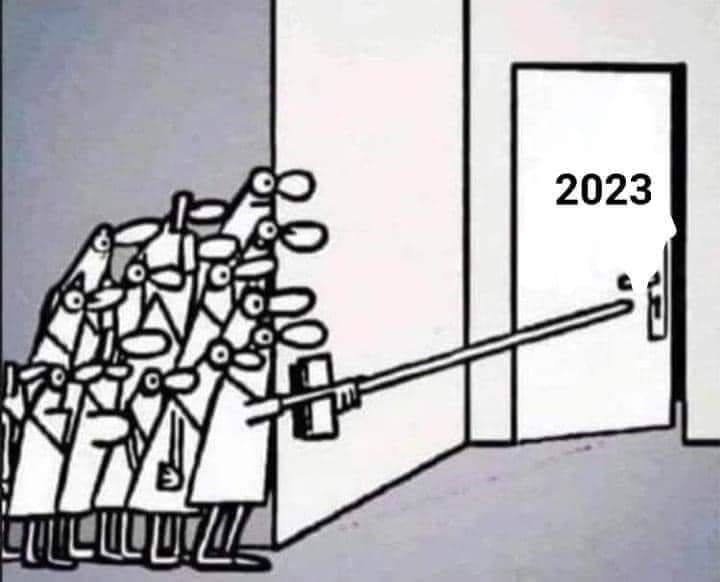

Hi and welcome back. We got xmas celebrations out of the way, then after that we finally managed to start 2023.

2023 is divisible by 7. Good, it irks me right from the start.

What do you know, I’m allergic to the concept of 7 for some reason.

Jokes aside, It’s now time to resume our digressions on the financial markets! And look, this is going to be a mixed bag, because I can’t possibly begin to cover all that has happened since last time I wrote. So I’m going to focus on notable bits on a first-came-first-served basis.

And if you read these pages maybe I don’t have to reinstate the obvious: 2022 was just a preview of what is to come.

Tesla

I wrote about Tesla in this article right at the start of October:

In the article I went back and forth, discussing bullish and bearish points for the name, and came up with a number of reasons why the company would be facing challenges, first-in-line its founder Elon Musk: a person who ascended to the role of cult leader back at the time.

And I pointed out the early signs of the tide changing on the public sentiment over its public persona, and the risks involved in the most outrageously idiotic business deal in history: Musk’s acquisition of Twitter.

And I received some backlash. Not as much as I would have hoped, because basically no one follows me. But I got some.

They say to put your money where your mouth is. Very well, so how did that trade turn out?

Look, I don’t wanna lie. This has been the most profitable trade in all 2022. The Sacro Fund (i.e: me) went in with high conviction, all guns blazing. Bought PUTs sold CALLs multiple times all until today. This trade really turned out to be a money printing machine.

Very, very seldom obvious directional opportunities like this one pop up in the market. When they do, you want to be on board. There’s no waiting in the sidelines or taking the opposite side of the trade.

It’s been a massacre for the stockholders of the name -56%. A staggering 72% loss from ATH, just 12 months prior. Incredible.

Clearly it was impossible to anticipate a value shift of such magnitude, in the #2 most traded stock of the entire US market, but it was very clear that the hype bonus was expiring for Tesla.

And this isn’t over yet. To be clear, Tesla is an OK brand. It produces wealth. But from now on it has to be priced and evaluated en par with its competitors, not like the composite sum of all of them.

So don’t talk to me about investing in the name until I can get it around 50 or 40.

And I’m currently very cautiously LONG the name, because it is very very oversold, and a rebound is coming. This is a speculative trade attempt, and I have low expectations and low conviction for this trade. I am currently holding a bull-call spread. I bought 130 CALLs, and sold 150 CALLs for hedging and to reduce costs, March 2023 contracts. The trade is currently in the green. Let’s see what happens.

Euro

I exposed the reasons for being short Euro against USD in a series of macro articles called the Melting down of Euro. Check it out, it’s fun.

That trade is now over, and what changed since then is that the FED has started decelerating the rate hikes per unit of time, are and were the leading factors driving the US dollar relative value upward.

The ECB in the meanwhile is playing catch up, because inflation is far worse in the EU than in the US, and because rake hikes for the Euro area started about 6 months later relative to those from the FED. The Euro has somewhat recovered since then, having the two currencies found some fleeting balance.

I have no forex position open at the moment. But some are coming as soon as the stars align, rest assured.

My long term view (years) of Euro remains that of an asset which is losing purchase power, however the same applies to its main reference benchmark, the US dollar. I’ll write more about this in an upcoming post.

China

I talked about my macro view about China in the Of Chinese pipe Dreams, and other distressed matters series. That makes for a shallow and somewhat entertaining stroll on the clusterfuck of problems that have been cropping up on the distressed continent. I had fun editing it, and it perfectly held water in the 6 months since then.

Much has happened, but nothing really substantial changed under the macro lenses. The geostrategic events that have been consolidating the outlook for the region are:

- Xi Jinping completing his years-long quest to purge the CCP of any potential dissent, and going full-steam ahead in an attempt to become the new Mao

- Zero-covid lockdowns, unsurprisingly being used as a convenient mass control tool for the CCP, and the also unsurprisingly capitulation of such system with a massive rug pull

- China is printing money like there’s no tomorrow in an attempt to revitalize its internal output and the falling real estate market.

At the end of the aforementioned series, a few question marks were left dangling. How the situation developed since then, has produced answers for those questions.

- The progressive distancing of China and Collective west economies is now irrevocable, and will steadily progress until something breaks on the geopolitical plane

- The CCP has decided to move against its populace in an attempt to extend its lease for the control of the system, and will happily reinstate control measures should chaos ensue

- The path is decided. China will likely deflate in the next decades, due to geological, economic and demographic damages that compound on top of a system that is discouraging competitiveness and merit.

Like many other mature economies, China too avoids all potential paths to recovery, but does so in a significantly more assertive and expeditious way.

Do we have a trade? Yes, I believe we do.

US-traded Chinese stocks are a good proxy for the health of the country. At the time of writing this, they are popping. I wouldn’t touch them even with my gloves on.

But let’s not forget that China is going to experience the same “reopening” challenges the west faced, at 10x the speed with 10x the damage. People have collectively accrued a good deal of savings to deploy, therefore I expect the Chinese market to pop a little more.

Then Inflation will become a problem, even more so than it did for the western market in 2022. This will happen on top of an economy that is propped up by constant quantitative easing that can’t really be stopped.

When that happens, all hell breaks loose. That is a short position that shall not be missed.

And I’m not going in selectively. When the time comes, I’ll be shorting Alibaba, Pinduoduo, Tencent, JD, Sinopec, all of them. And no ETFs. I want to see the names of these bloated carcasses directly in my book, and I want to see their blood. This is personal.

Russia

Is the “special military operation” in Ukraine ending, by the way? Did anyone post an update about this, that I did miss?

Why on earth the market, globally, is already pricing in a peace deal between Russia and Ukraine? Is this a done deal?

Guys, really. This doesn’t add up.

The conflict is still ongoing. And I guess this has a chance to become the first financial rug pull for 2023: assuming that the dragon is slayed to death, while it’s not.

“Oh but Sacro you’re a constant party pooper.

Russia retreated, Ukraine has more defensive forces than ever.

The war is basically over.

What reason do you have to be so doom and gloom all the time?!“

Let’s just say that I have a hunch.

But I understand, you need facts and pointers. So here are some:

For starters, peace talks have been bilaterally offered multiple times, and nothing came out of it.

This is a very, very, very bad leading indicator.

Russia’s policy on negotiating a peace deal is, and has always been, a very simple concoction:

- Stating unilateral demands

- Refusing to concede on any request from any other party

- Awkwardly waiting at the table until the opposite side capitulates and concedes something that wasn’t previously offered.

And that is basically all that there is to know about peace talks involving Russia. They are militarily losing ground, but Russia’s commitment to this conflict is unabated, and their negotiating recipe stands unchanged. Therefore no deal has any hope to go through.

Did anyone give a glance at what has been brewing inside the Russian media bubble lately? The amount of reactionary nationalism has peaked to North Korea levels, and now a new breed of rhetoric is being produced to influence the people: that of the concerned citizens.

This is amounting, in my opinion, to only one thing: a new wave of conscriptions is coming, and I fear the first one will pale in comparison. The Russian dictatorship is probably going all-in with a massive gathering of offensive forces as soon as the ice thaws.

What if this happens? Several setups may occur across those assets which may have made the mistake of discounting a done-deal scenario:

- LONG Energy

- LONG US defense

- LONG US Dollar

- SHORT Italian banking

- LONG Agriculturals and softs (Wheat, soybean oil)

Real Estate

No news there. Rates go up, market goes down. High rates hurt the very scum of the earth, companies who spent most of 2020-2022 snatching up homes at inflated valuations for the sole purpose of creating a cartel to drive prices even higher.

Those criminals are the culminating reason why regular people can’t afford to buy a home anymore, and the reason why perfectly fine cities go through an accelerated and magnified process of homogenization of their lineups and gentrification.

I hate those people.

What they have done should be illegal.

My Blackstone short position is still open. It hasn’t stopped printing money.

Oh, and the aforementioned real estate fund has effectively frozen redemptions, which is apparently something they can do, trapping speculators by their genitals.

I can almost feel their pain, and it gives me great pleasure.

I doubled down on my short position.

Energy

The money printer for 2022 has been, indeed, energy.

Crude oil, Natural gas, energy stocks, you name it, everything went up and, most importantly, it continued to stay up.

That trade is now expiring. I’m mostly out, but I’m keeping a few positions. I like Valero, Chevron, but I’m ready to kiss them goodbye. We can expect the market to start pricing in a recession from now on, and Energy could become once again the trade of the year, this time to the downside.

Recession destroys consumption, an effect which is amplified for energy consumption. Energy stocks are forced to reprice down, as an effect of reduced margins.

But let’s not go there right away. Energy commodities still have the groundwork to pop once again. Russia, US aggregate demand, Natural gas demand due to longer of harsher winter, OPEC+ manipulation, all of these factors can trigger a price spike at any time.