Table of Contents

- Heatmap

- Options

- Europe

- US Q3 GDP is Positive! Soft landing achieved!

- Earning for $AMZN – Amazon!!

- Credit Suisse

- Earnings for $AAPL

- PCE Numbers out today

- Trade scratchpad

We got earnings for $AMZN and $AAPL. And with that the best part of earnings season is behind us.

Those were bad. The market now is dangling by a thread, waiting for the PCE data: the piece of data that the FED also looks for. The market hasn’t had a meaning of its own for a long time now, it only goes where the FED goes.

These are the times we live in.

But anyway, Nasdaq and S&P both down, while the Russel 2000 holds and Dow Jones closes positive. A clear divergent sign. The growth parts of the market keep going down while value still holds.

One way or the other this divergence will be resolved, and of course, this will happen to the downside as soon as the right trigger is pulled. (Recession? Ugly inflation data? Let’s see)

But right now the market participation is still high, for whatever reason.

- US Dollar up 0.90%. Changes nothing at all, short term momentum still to the downside.

- To confirm that, US 2-year yields went down almost 3%

- And Crude Oil closed almost at 89, not bowing down to the strength of the Dollar.

This is overall bad news for future inflation data.

- Also, VIX showed no signs of life in either direction, despite the disastrous earnings. It remained stable at around 27.5.

- As per usual, EU session entirely uninteresting.

Heatmap

Overall negative, the theme of the tech megacaps being red continues. This is the trend for the 2022 folks, and so far there is nothing to conclude the end is near. On the contrary, tech valuations are still 20x plus, crazy-high. 20x are akin the multiples we saw when the 2008 crash happened.

A lot of money still has to go. Burn, baby! Burn!

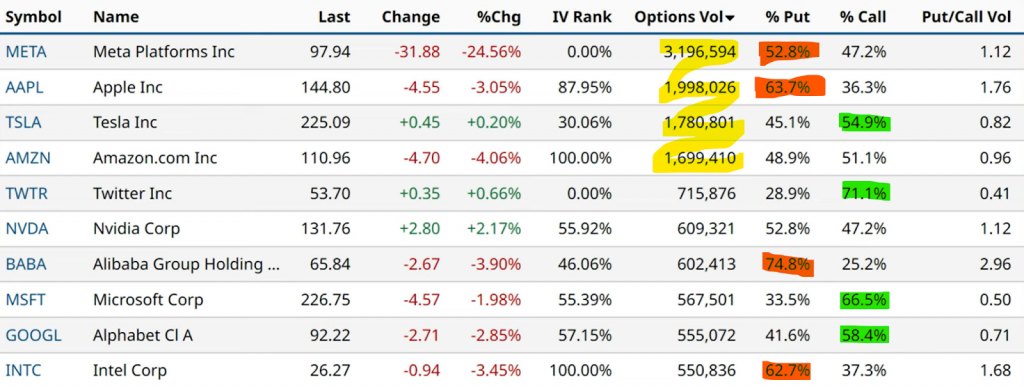

Options

Volumes keep flowing. Mostly on bearish bets, but there are some rebound plays happening in Tesla, Microsoft, and Alphabet.

Oh, and Twitter. Musk bought Twitter. Did you know that?

The $TSLA bullish play is interesting. Tesla got probed by the DOJ for the Autopilot woes. (About time, if you ask me). And also the Twitter deal going though means that a lot of Tesla shares will be dumped to raise the cash. Both bad news for the name. Who knows something?

Or maybe it’s an attempt at laddering up the stock. We’ll see.

Europe

ECB raising rates (75bps). The EU economy is collapsing first. We know that right?

But the media wanted to focus on an irrelevant piece of news for a bullish narrative: the ECB commission did not manage to land an unanimous decision about the 75bp rate hike.

I say who cares. 150bps are coming for sure. It isn’t just me who says this:

In response to the rake hike, instead of gaining, the Euro went down against the US Dollar for a whopping 1.2%.

Unbelievable!

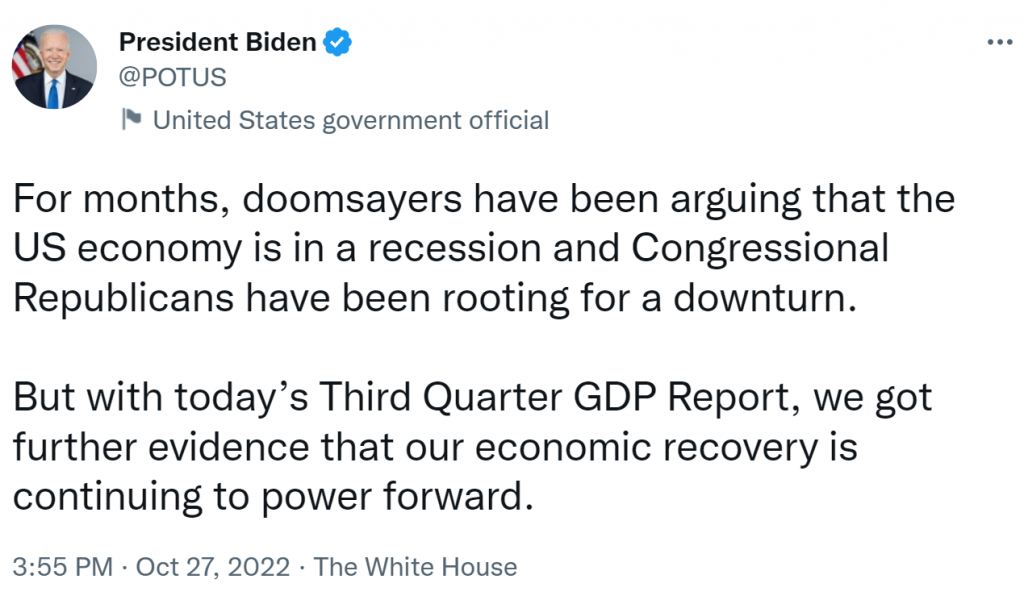

US Q3 GDP is Positive! Soft landing achieved!

First, I’m honoured to be among those named doomsayers from Joey. It’s a badge of honour.

Thank You mr. President.

Second, let’s look at the numbers. These are troubling numbers. Here’s why:

Yes, Q3 GDB shows some growth. But look at the composition of the candle. (And this is cooked data of course, so the reality is even worse).

- The vast majority of the gains are due to Net exports.

*tadaaaaan*

Remember the US Dollar being so strong, at all-times high. This is damaging to US exporters as a whole, but in monetary terms it contributes positively to the GDP. Look at 2021. This entry with a weak dollar was basically non-existing. - The second contributing factor is Private Domestic investment, which is basically a measure of the productivity increase for the overall system.

Now listen: both of these are time bombs. The US Dollar, in absolute terms, has lost value. This is going to be evident as soon as the yield curve reverts back to normal. And on top of that, the FED is forced to actively destroy the second slice of the pie. The FED is out for blood. It wants to see unemployment to go high.

Future GDP figures are going to be annihilated. There is no way around this.

Technically but not formally the US is already in a recession. A deep one. Look at Personal Consumption. It’s disappearing!

Here are the numbers for residential investment & durable goods. The backbone of the US retail market. I’m not going to comment on the chart. You do you.

Here’s what Peter Schiff, which is a character which I happen to like, has to say on the topic:

Earning for $AMZN – Amazon!!

Unbelievable.

Wh? What happened?

Numbers, folks! Always look at them numbers!

Let’s begin with the good ones:

- Net sales YoY up almost 15%

End of the good numbers. Whoops.

But here are even more numbers:

- Expenses up almost 18%. Which I don’t need to tell you how much it’s bad.

- Operating margin in 2021 was 4.3%, in 2022 went down to 1.9%. Which isn’t bad. It’s catastrophic.

The company earns 1.9$ per 100$ invested. Operating Amazon is expensive as f.

- Oh, and by the way Net Income is displaying a loss for (-9%)

Look, I’ve made you a chart.

EPS is negative. Again. And it keeps falling. The company thanked stockholders by losing them money for the two consecutive quarters.

But here is the worst part.

Net sales went up for the US market, but went down for international outlets. What is going to happen as soon as the US customers start to feel the same way EU customers are feeling right now?

And AWS slowed down by a lot. Confirming the trend already revealed by Microsoft’s Azure sales.

Amazon has to be repriced down, by a *lot*. The company is paying enlarged wages, due to the stimmies, and basically can’t shed much of the workforce even in case of need. It is a dangerous a company to operate.

AWS, which has been the growth asset so far, and the largest cash cow, is entirely dependent on a skilled workforce, and its business model does not allow at all for a future downscaling of the infrastructure.

And the Retail sales sector collapses as soon as Black Friday comes. Laying off people is basically a non-starter.

Credit Suisse

Listen folks, it’s no secret that I can’t stand Credit Suisse. It’s truly a massive conglomerate of evil and bad intentions.

Every time a scandal is uncovered, be it money laundering, warfare profiteering, unlawful takeovers or speculation on opaque assets, rest assured the name of Credit Suisse is going to show up.

Me, personally, I can only derive intense pleasure witnessing the dumpster fire that this institution has become. Yesterday $CS has consolidated a 96% value drop since its highs. And look at the volumes.

Staggering.

This stock is going to zero. I can guarantee it.

And if it crashes for good, a lot of other names are going to fall with it. Taxpayers are going to pay for its bailout, as usual, and it’s going to be a whole new steaming crap to deal with.

But overall I’m viscerally happy to see these bunch of criminals go as they burn their home down.

Earnings for $AAPL

Apple is a lot more resilient than its peers. (It only went down 5% in after hours!!!)

But the bad tide is brewing. It’s in the pipeline, baby.

Numbers!

Overall it’s good right?

It’s still showing a profit for the stockholders, right?

Meeeh, think again. Apple has been juicing its “Service” asset, it’s high-growth engine.

What’s this “Services”?

Clueless Joe

The “service” sector for Apple coincides with the App Store. The racketeering operation which extorts all users of a 30% slice over all of their purchases. And I don’t mean purchases toward Apple or the App store. I mean all purchases operated via iOS. It’s illegal of course, but 100% of the Congress owns Apple shares.

But this cash cow is drying up fast. People are more selective now. They don’t exactly like being denied payment options for online services that don’t bow down to Apple and give up 30% of their income, which is basically all of them now.

But, but wait! Wasn’t Apple making Phones? And iPads?

also Clueless Joe

Yes, the margin on those is thinning. It wouldn’t be the first time, if it happens, that Apple is selling hardware at breakeven costs. Net Sales being up match exactly the Cost of Sales in terms of increase. Apple still has some pricing power, but realistically how much will that last?

The customers aren’t going to pay for a grossly overpriced 16” iPad if they already have maxed out their credit cards. Save for the M2, which isn’t a particularly spectacular chip compared to M1 anyway, Apple has basically no new assets to sell down the line.

Overall, and after the recent crash, $AAPL is still valued at 20+ earnings. Why do I pay 20x a negative outlook?

PCE Numbers out today

The PCE numbers are out during premarket. This, literally, decides where the short-term direction will be. Last time the CPI numbers were bad, and we saw capitulation after a new lower low.

This time there is still a lot of falling to do before making a new bottom.

Trade scratchpad

- $XHB long 20%. In profit. Looking for confirmation (further yield decreases)

- $MPC long 20%. Added 0dte CALLS. It’s basically a gamble, if it goes it goes

- $VLO long 30%. Added 10% on the low close

- $QQQ short via 0dte PUTs. Also a gamble. A cheap one.