Hi Everyone! It’s been kind of a holiday season for the last few days in Italy. Because you know, the country’s productivity index is way too high.

In the meanwhile what happened to the market?

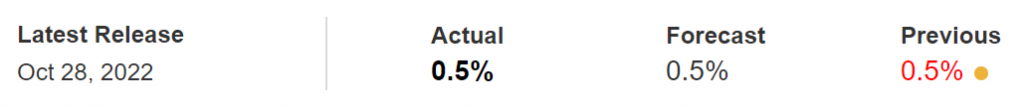

PCE Data

We got the latest PCE readings, and they show no slowing in the inflationary push at all. How they can be interpreted as bullish news, baffles me:

Oh wait, perhaps the Core PCE Month-over-Month readings were particularly good.

But hey, at least they didn’t overshoot the forecast, so that has to be good news right?

Well, I say if you want to interpret it that way, be my guest.

My interpretation is: Midterms are around the corner, one has to tone it down the pace of apocalyptic news just a little, you know? It may also be the case that the routinely cooked PCE numbers, this time were particularly massaged and seasoned too, to make them look better.

It wouldn’t be a first. It happens all the time.

Earnings

Earnings week finally is behind us. And boy some of those were abysmal, truly a horror to behold. (recaps: 1, 2) The stock market decided to have its Halloween party early this time.

- Microsoft down 10% from its latest swing high

- Google down 13.5%

- Amazon down 19%

- Meta down THIRTY-TWO-PER-CENT! Unbelievable.

And what do you know, the market didn’t even take the hint, and proceeded to shrug it all off. Why? Because of optimism in the news, and by proxy, in the retail investors. They like to call it the “dumb money”.

Here are the two key pieces:

- Apple reported earnings that are showing massive problems mounting up, but managed to recoup the price drop and even close the week in POSITIVE

- And even Tesla managed to do the same, in the wake of positive (possibly fake) news from China.

What news were bought?

But what did happen in response to all of this?

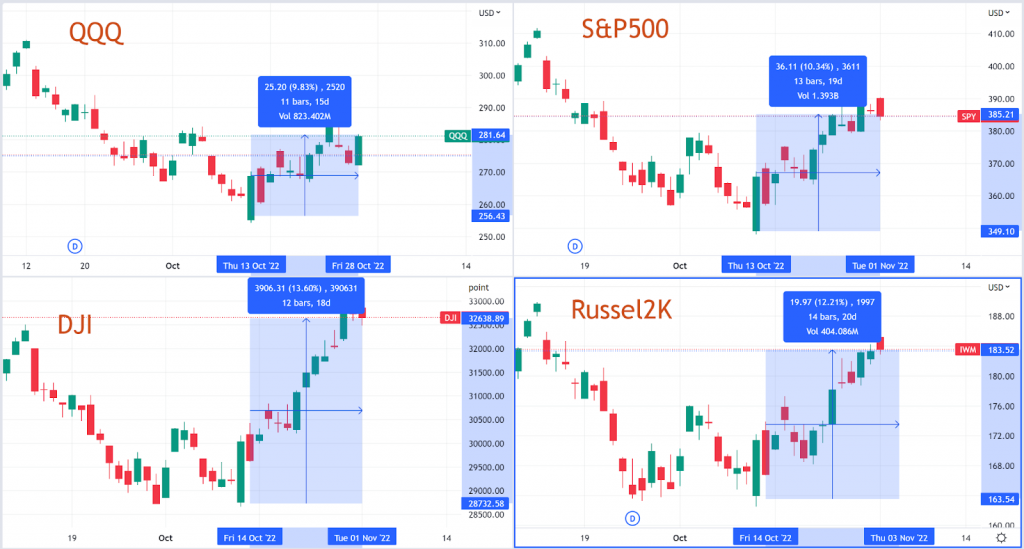

Accordingly to $AAPL, the last was one of the best weeks of the year so far. Everything, small-caps, S&P, Dow Jones and even Nasdaq managed to close in the green, with substantial gains.

Recession successfully averted. Congratulations everyone.

Why?

- Because a FED pivot is assumed to be happening.

- And because of rumors of China re-opening, and re-embracing capitalism and the end of the zero-covid policy.

- And I guess flocks of pigs were seen flying south in the sky, I guess in preparation for the winter season. Because why not, I’m ready to believe that too.

The market is heading into the FOMC meeting this week with the biggest hard-on ever. There is going to be a PIVOT from the Fed toward an easing of monetary conditions. A smaller than planned rate hike or even a pause.

Market participants are 100% sure of this. And I mean all of them.

I’m having what they’re having!

There is a thing I’ve learned about trading, at great expense for myself: always CHOOSE when to be part of the herd. Never let it drag you in, always evaluate when it’s the right time to join.

Otherwise you’re gonna be a lousy trader.

And confronted with this magnitude of conviction I admit I started to second guess myself. A number of speculations crop up quickly if you start to count them:

- It is entirely possible that the FED is going to appease the government until the year’s end in order to “facilitate” the midterms results;

- It is also entirely possible that the FED is aware that something big is at risk of snapping up under tighter monetary conditions, and simply doesn’t have the balls to go against the pressures of the oligarchs;

- Maybe there is unreleased news in the pipeline that will force the market upward momentum even more, that I do not know of. Like a relaxation of the Ukraine conflict, or China capitulating to its recent spike of kleptocratic lunacy and backpedaling on a number of policies.

And any of these things happening can easily push the market up another 10-15%. Such is the strength of the drug withdrawal from market operators.

But the point is that regardless of any possibly unreleased news, we have to run the numbers that are out. We don’t buy the rumors. Why?

Otherwise we’re gonna be lousy traders.

And here are the conditions that JPow clearly enumerated, that have all to be verified, in order to induce the FED to halt the pace of rate hikes:

| Metric | Necessary condition | What happened instead | Are we there? |

|---|---|---|---|

| Growth | Has to slow down | GDP Q3 positive | Nope |

| Occupation | Unemployment must rise | More job openings than ever | Nope |

| Inflation KPIs | Must stably approach 2% | Increased both YoY and MoM | Not even close |

I don’t see any reason why the FED should slow down the hikes.

Furthermore, every time the market as a whole stages a bull run, that undoes some of the work done so far by the FED. Which has reasons to tighten even more.

But you know what? Let’s look at the ECB for once. The ECB last week had the chance to hike 50 basis points. The EU economy is down the drain, inflation is much much higher than in the US, and it’s going to be worse. The ECB has a number of valid points if it wanted to slow down the pace. But they raised 75 basis points as planned. Why should the FED do anything else?

And OK, Bank of Canada slowed down, Japan too, but they are reconsidering not even 48 later. Inflation is finally catching up to them.

Market recap

But anyways, ok ok we have to cover the market behavior so far. I know.

So what happened since the PCE data release?

- VIX decline continued linearly, stopping at the low of the 30-25 range (bullish for equities)

- US Dollar (DXY) made a new low at 109.5 and proceeded to retrace up to the 111.5 resistance (bullish for commodities and energy)

- US 2-year notes are still paying over 4.5%, an attempt to sink below the 4.3% resistance was rejected (bearish for equities)

- Gold is not having any of this bullshit, and continues scraping against its support at ($GLD ETF) 152. Gold isn’t believing that the US Dollar will go anywhere but up.

China stocks and ETFs staged a comeback which is news-driven. It’s a good chance to go short there.

Heatmap

The theme continues: Big Tech is red. Everything else is bullish and greenish. Overall, up we go. A nice hot-air balloon takin off with a turd inside.

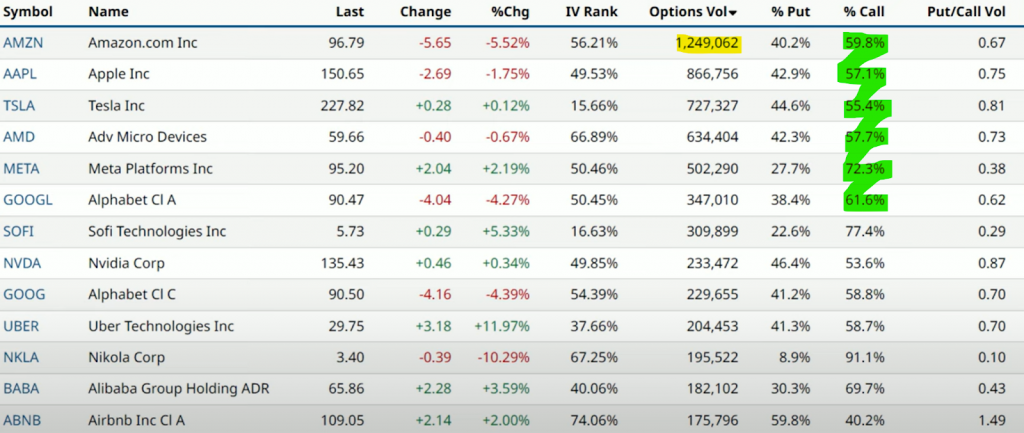

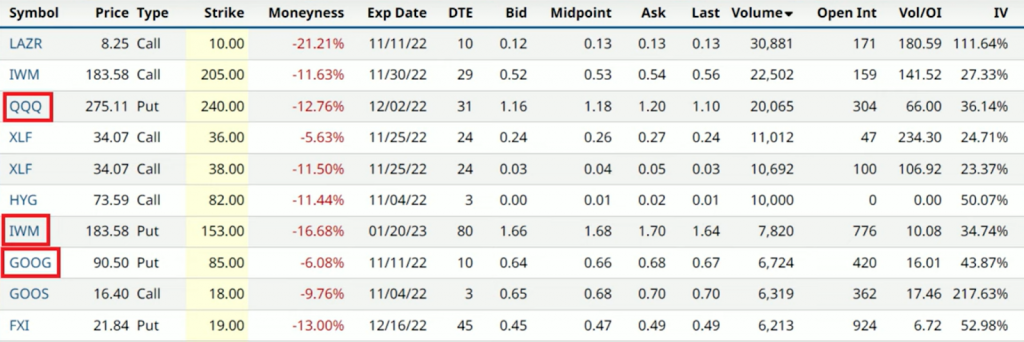

Options

Finally the options market is slowing down a little, ahead of the FOMC meeting, but volumes are still appreciable. Note the blatantly bullish betting, it is happening across the board, and this signals conviction to push the market higher.

The FOMC meeting starts today folks. If these guys are to lose their bets, market makers are ready to flush the market down in a fraction of a second. All of these contracts will expire worthless.

And there are people who are seeing the bluff. Notable trades on the options market from yesterday show heavy betting against the Nasdaq, Google in the name of the Big Techs, and even Russel 2000 with the small-caps.

Energy

And what do you know? Energy is staging a comeback!

So far the saucer formation is playing out, and Crude oil approaching 90 is very bad news for inflation. Apart from the technical reasons (the asset being ready to retrace), there are a number of news that are pushing the price. First in line, rumors of China “re-opening” and Iran planning to attack the Saudis:

That’s going to be an interesting one, if it plays out.

$META

We have to talk about Meta, which is now down 75% from its peak. Much of this damage was done in the last few days. To witness a candle of this type is an historic event, not even Bitcoin used to be that volatile.

To say that Bitcoin is now more mature than the company that brought the social network revolution to the world, is a harsh statement about the times that we live in.

However, a movement of this magnitude leaves such liquidity voids in its wake that as soon as the profit taking starts on the short side, price can easily spike up 20 or 30%. We have to be ready for that.

My plan is to purchase way off-the-money calls with long expirations and sit on them. In the event of any retracement for the name, those contracts will be repriced higher even if they remain out of the money. This is a very low-risk low-pace trade.

In other words, this isn’t an investment. It’s a speculation. Meta is a shit asset right now. But given the recent developments it is possible, even probable, that Mark Zucchino will be forced to the sidelines, and the Metaverse lunacy will be forced to fade. That would push the expectations for the name higher. It doesn’t take much at this point.

Trade scratchpad

- $XHB trade wasn’t playing out. Closed at breakeven.

- $MPC confirmation achieved. Long increased to 30%. Waiting retracement for another 20%

- $VLO unchanged. Still in gain. Waiting for confirmation.

- $QQQ short via put didn’t play out. Closed at small loss.