No, Italy is not under heavy attack. At most, this qualifies as a mild attack.

So basically what did happen was that the Financial Times came out with this article (unpaywalled link here) detailing how and why the global hedge fund arena is placing massive bets against Italy’s sovereign debt.

The buzz.

Italy established victimism as its signature move during the 1920’s: it came packaged with other bad habits, many of which sadly still persist one century later.

Therefore this piece of news has touched more than one exposed nerve, because it feeds into the wildly popular theory that the EU is unjust, it hates Italy, and right about everyone is scheming to give Italy a bad time, and yada-yada-yada.

It’s incredible how the whole domestic media industry, which is normally very polarized and fragmented, can jump all together on the same bandwagon talking shit about an evil foreign menace at every possible turn. They love it soooo much, the news has been taken and “biased” into oblivion. At the moment the shitshow that is the 2022 election campaign is ongoing, and this piece of news has had the same effect of kicking the hornet’s nest.

I am not going to feed into the buzz that ensued, it’s not my thing. However I want to go a little against the grain and try to describe why this is really happening and what I personally see into it:

This is a battlefield

Sacro (2022)

with a new level of stupid

on both sides of the fence.

Italian debt packaging.

For the uninitiated: Italy markets its sovereign debt under a surprisingly large variety of bonds. Our observation here will gravitate around Italy’s roughly equivalent of the US 10Y T-note, the most popular security: the much loved/hated BTP, “Buoni del Tesoro Pubblici” (Public Treasury Notes), specifically its 10-year cut.

The only major foreign buyer of this security is the ECB. Which is the way the ECB feeds Italy the much needed cash it needs to, in simple terms, not instantly collapse on itself. The ECB’s relentless buying maintains the price of the asset somewhat high.

In today’s conditions, basically no one else would want to buy the BTP: its inflated price, the country’s proverbial instability, and its fiscal policy teethering on the edge of being outright suicidal, makes the BTP a risky asset that has no other compelling market.

BTPs are not really popular between domestic retail investors either. The vast majority of the domestic BTP holders happen to be Italian banks.

Should the BTP be allowed to perform price discovery, its value would sink to a much, much lower value.

…it would be downgraded from its current Lower Medium Grade rating, which would make its price fall way more, and the country wouldn’t be able to service its coupons and/or return to the holders its notional value at maturity date.

This is how the country’s scenario of default would likely play out.

Instead, the ECB keeps buying the BTP by using the TPI guidelines, and other means. Therefore the BTP price stays relatively high and Italy enjoys comparatively tiny debt service costs as a result.

This means that the value of the security is artificially inflated.

Which, at least in theory, opens the door for a trade opportunity. This is the starting scenario for the offending trade outlined in the above FT article.

What’s at stake?

The FT article mentions that hedge funds have mounted a €39bn short position against the 10Y BTP, which happens to be the largest short position in existence since the 2008 financial crisis. Here is the offending chart:

While it is true that the hedge funds have indeed generated the largest short open interest since 2008, in notional value, I think this is sloppy journalism. The number can’t be taken out of context.

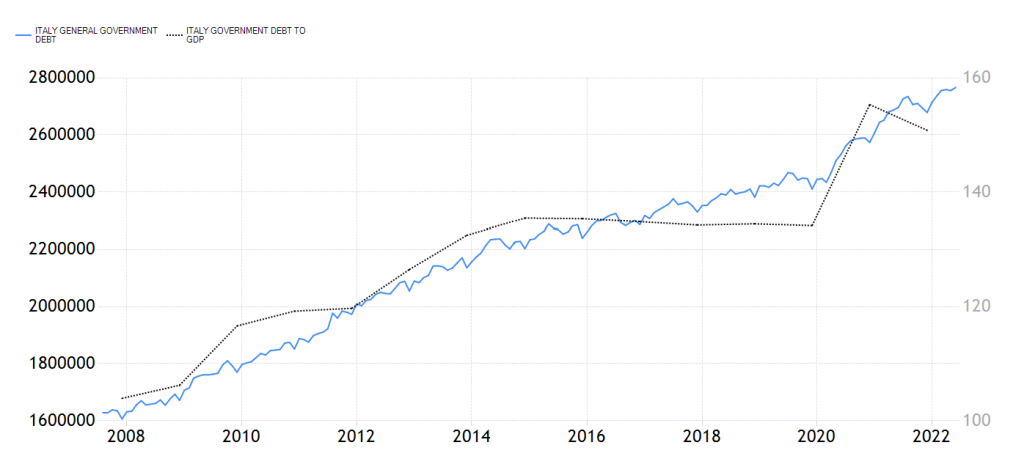

The situation today is very different from 2008. Look what happened to the country’s sovereign debt in the meanwhile:

The country has been burning money like a drunken sailor with absolutely no benefit to itself.

N-O-N-E. Zero returns whatsoever. The country’s GDP stayed basically flat the whole time, while its debt ballooned 75%. SEVENTY FIVE. An insane amount.

So let’s take into account this fact too, shall we?

According to the Ministero dell’Economia e delle Finanze (Ministry of Economy and Finance), around ¾ of the country’s debt is currently financed by BTP holders. Assuming that half of that has been historically stored in the ever-popular 10Y notes, by being short €40bn worth of BTP the hedge funds would have had in their hands, in 2008, a short interest of about 6.5% against the total floating amount of the security.

Today the same position has not the same impact at all.

The country’s debt has grown so much that if we get to see a €40bn short position, then that would mean that hedge funds have in their hands a short open interest of around 3.8% of the security, a percentage which pales in comparison to the 2008 short trade.

This operation has nowhere near the market effects that its last iteration had in 2008.

Why now?

Hedge funds are simply attempting value extraction from the bond market, forecasting future volatility of the asset.

And to be clear, this in principle should be is a sure bet. 100% hit rate.

Why?

Because Italy, like always, is behaving as the proverbial sitting duck. Elections are due. The contending parties, which will become the new government, have different agendas but all, without exclusions, involve strong debt expansion.

So, despite the winner, at election time the market will price in:

| What is likely to happen next: | What are the effects: |

| More debt emissions | Lowers the value of the BTP |

| Debt service risk hike | Lowers the value of the BTP |

| Institutional sell-off due to the two above | Lowers the value of the BTP |

The assumption at the basis of the trade is right: Short the damn thing, and wait for it to fall even more due to organic exogenous effects.

The trade in 2008 paid off. Today is paying off too:

Vertical drop in conjunction with the recent government’s seppuku ceremony.

But it remains a stupid trade.

I’ll tell you why.

Mode and timeframes.

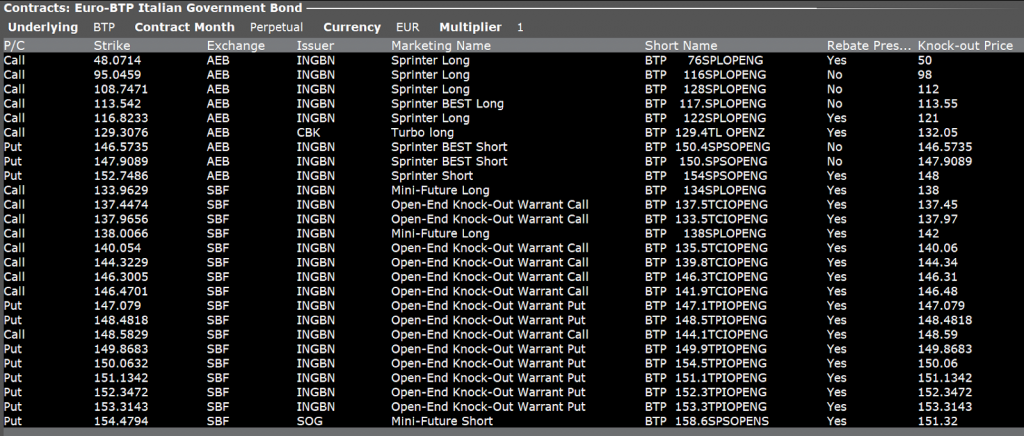

Like any other tradable security, if one gambles at the right table, Italy’s BTP can be sold short too. If one is not already a holder of BTP reserves to sell, the only practical vehicle to mount this type of position is by using futures contracts.

This is an expensive proposition for the typical retail investor, however it’s not unheard of.

BTP bond futures aren’t very liquid vehicles. Institutional market makers (banks) populate the trade book waiting for a counterpart. When forced to assume a position they will buy or liquidate the corresponding amount of BTP on the market, and pocket the price spread which is quite large.

And here lies the salty part of this trade.

During 2008, the ECB was not buying sovereign debt like it is doing today. On the contrary, today the majority of the BTP notes show up in the ECB’s balance sheet.

Aaaand, the ECB is not a for-profit organization, at least not on legal grounds, which means that it is not lending its owned assets away. Therefore the majority of BTP notes are not available to short sellers. The only source of BTP notes to short, are from private banks. This makes them rarer, and short selling them is more expensive than in 2008. This is priced-in into the futures trade price.

Furthermore, the ECB is not interested in materializing a gain, or stopping a loss. Should the BTP decline in value, the biggest buyer of that security would … just continue buying.

It’s the freakin ECB, they don’t know how to do a damn thing other than buy s**t.

So, hedge funds placed their bet against, basically, the firepower of the ECB and the TIP bond purchasing facility. That is a stupid, stupid, stupid thing to do.

And, to make things worse, they have a shorter time frame to succeed, compared to 2008. They have to roll their position each time a futures contract expiration date comes. This is an expensive bet, the longer it runs, the more expensive it becomes.

At some point the hedge funds have to cover. They will have to cover against the firepower of the ECB, at their own expense. In a typical hedge fund fashion, this will probably happen in the winter. After the formation of the new government, and before the books are finalized for the year.

I’m sure this will pay reasonably well, however good luck with that.

Involved risks.

Who pays for what the hedge funds end up pocketing?

Meh, primarily this is a move at the expense of the ECB. Italy isn’t really hit hard by this trade. Not in an appreciable way. Bond auctions happening in the second half of the year will probably be impacted by the perceived risk hike, but the risk is manufactured by the craziness of the prospective new government, not so much by the hedge funds shorting the country’s debt. They simply don’t have that power.

Despite what the bruised nationalists’ ego will decide to believe, the hedge funds aren’t making Italy fail any more quickly. Not more than the country is doing autonomously.

To better gauge what is the market’s perceived risk about an sovereign debt default, it’s better to look at what the Credit Default Swaps for it are pricing:

It isn’t good, but we’ve seen much much worse than this.