Table of Contents

- Commentary

- Options

- Heatmap

- FED Tightening cycle

- Inflation persistence

- A regime switch is creeping in

- How to make up the new watchlist

- Tesla

- The big trade on Energy

Welcome back. Funny times huh? FTX getting rid of your money, Musk getting rid of Twitter, the mortgage most people aren’t paying. Yes, funny times. But what has happened this week? Let’s see.

Commentary

The market is wrapping up for the year, the bullish push continues, but the FED’s hawkish rhetoric managed to put a cap on that, albeit temporarily.

Then the aftermath of the FTX mega-failure continues to have ripple effects, which are mostly visible on Financial names and Tech, for some reason. (Just kidding, we know the reasons).

| Week close | Overall market effects | |

|---|---|---|

| Dow Jones I.A. | +0.25% | Consolidation |

| S&P500 | -0.58% | Consolidation |

| Nasdaq100 | -80% | Consolidation |

| VIX | Closes at 23 | No indication (unable to go lower) |

| US Dollar | +0.65% | Bearish, slightly |

| 10-year yields | -0.30% | Bullish, slightly |

| Gold | -0.92% | Bearish, slightly |

The week’s performance doesn’t provide a clear trend. The volatility hasn’t been particularly high and volumes are overall low, hinting at a possible resumption of the upward trend.

As we discussed recently, the market participants still have a good number of sessions to lock in gains before the year closes. Most of that sentiment has been muted by other worries (more on this later), but the technicals to climb up higher, especially after a week of consolidation, are still intact.

Leading to a temporary market decline instead is the US Dollar, which is ripe for a rebound.

Options

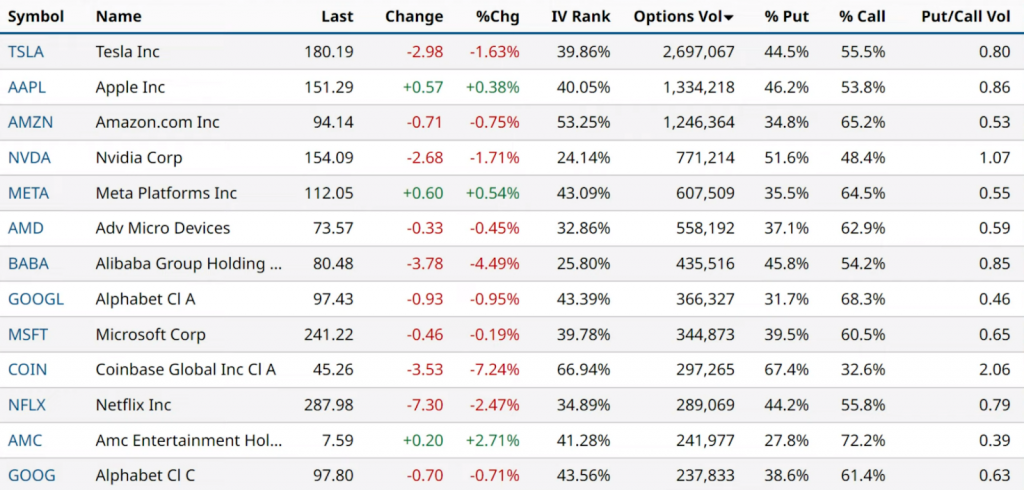

Friday was options expiration day, we are going to overlook the increased volumes. We can however observe the bullish theme resuming. The vast majority of the open interest created Friday are CALL contracts. Up we go!

Heatmap

The heatmap for the week is a bit more clear than the daily. The effects of the algorithmic buying fade if diluted across several days, and some trends emerge.

What has been winning for the week?

- Consumer defensive

- Healthcare

- Utilities

The losers?

- Materials

- Consumer cyclicals

- Energy

- Real estate

It’s a new theme? What is compatible with this market reaction? What is the market saying?

Wha? “Recession” you say? Perhaps, more on this later.

FED Tightening cycle

JPow most likely will relax the pace of the tightening cycle, by going with 50bps on December, instead of 75. This piece of news, which was largely anticipated by the market and elected as a strong bullish mover, well, it isn’t news at all. If you read the commentary from the FED’s cronies (one or two of those per week end up being interviewed) a slowdown in the pace of the tightening has never been denied. Even by the most hawkish ones.

The main point regarding what the FED is going to do is anticipating how much the FED is going to raise interest rates. How much time this will take, that’s a very minor factor here.

And look, there is no consensus here: it varies from 4.5% to 8+. Why? Because it depends on how much inflation will stick.

Inflation persistence

And despite the fact that the market is starting, subtly, to account for a future recession cycle, at least for now inflation largely demonstrates to be very much sticky.

How do we know? It’s simple. Three factors:

One: Inflationary moves are sticky by nature.

Most consumer staples and basically all non-durables don’t reprice down when inflationary drivers cease. You think the overall size of a can of soda is going back to what it used to be in 2019? Think again.

Companies who had to stockpile by paying a massive input premium, if they can, will always price that premium to the customers, and retain it for the long haul. Thus adding to the sticky inflationary component.

And the same dynamic applies to commodity-sensitive prices, house prices, rents, and so on.

Two: The US Dollar monetary base is still bloated.

The FED has effectively started to absorb it, but the job is far from being complete, the hardest part has yet to be done. Draining the market of another 35-40% of this monetary mass is going to break something, and yet it needs to be done. This unfathomable amount of money is begging to come out again and chase assets, if given the chance.

Three: Every time the FED slips and a hint of dovish rhetoric gets to the market, it ends up blasting the market higher.

This means that market participants read the move as “bottom achieved”, rushing to buy bonds with a very palatable 4.5% guaranteed yield, which makes yields fall and the end result is an easing of monetary conditions. Which ultimately ends up undoing the FED’s work.

A regime switch is creeping in

This week, for the first time after a loooooong time, the market has started to act not entirely on the basis of something the FED has done or said. Perhaps in the near future we will have a rare chance to experience a market that isn’t entirely FED-driven. And I say that would be great!

But what is the market reacting to? Recession.

This week we got two indications that the FED’s “soft landing” scenario could definitely be off the table, and the recession we are going to face could be deeper than anticipated.

I’m wondering which reality these people see. The economy is completely trashed, globally, and they come up with statements like “Oh look, this might be bad”. What a bunch of morons.

But anyways, the yield curve inversion is starting to look bad:

And the LEI Index declined month-over-month for the 8th consecutive time, checking in another -0.8%. It’s in full swing down.

The market is confused. We are witnessing the conflict between the end-of-year enthusiasms (i.e: the wish to get larger bonuses, those poor hedge fund’s managers are down 40% on their usual paychecks), and a recession that seems unavoidable and creeping in.

Is the bottom in?

Most market participants aren’t seasoned enough to understand how bear markets work, and are ready to read any bear driver as a contrarian indicator. It doesn’t work that way when the market has all the reasons to sink even more.

The “bottom” isn’t here because we haven’t had a replay of what created the previous market bottoms: a FED pivot.

Did we have a FED pivot? Did the FED announce a rate decrease?

No.

Then we didn’t see the bottom yet. And this is still relevant.

How to make up the new watchlist

There are a number of names that remain profitable, and even increase in value, during a recession. We have to focus on those names which have the pricing power to offload increased production costs to the customer, but will retain it during the recession phase when production costs decrease. These names will experience increased earnings and better operating margins during a recession.

Are we finally talking about Technology? The ARKKKKKKK type of names?

Not even close. You perma-pumpers are going to eat gravel once again.

The names I will be scouting for are in these nests:

- Health care

- Consumer defensives

- Tobacco

- Alcohol

- Fast food

Rest assured I will be announcing medium-term trades here.

An important foreword: do not assume the market is ripe to accept these trades. The market, yes, is now showing early signs of transitioning toward a recessionary theme. But for all we know it can backpedal tomorrow. US Dollar and yields could display exaggerated moves one way or the other, and then the algos kick in and the market does its own thing, unrelated to any theme.

It’s better to sit on the sideline. I will be waiting clear signs that the market is going to submit to the new economic regime.

Tesla

The character that we call Elon Musk has seen its peak. It is now becoming increasingly toxic and has the power to alienate everyone who crosses his path. To me, he is as uninteresting as he’s ever been.

However Musk-driven headlines still move the market, and his actions merit a quick discussion on this block.

Musk’s net worth is almost entirely priced in $TSLA shares. Tesla, his company, benefited from a cult following which is mostly Left-leaning. But Musk, who is under pressure from many sides, here not including China, decided to drop the Left-leaning PR operation to bet on the opposing political side, anticipating a political switch.

He is now appeasing the political Right:

- The unwilling takeover of Twitter is being played in that direction.

- The corporations-against-workers rhetoric is being played in that direction.

- Even the being-an-outright-bully rhetoric is meant to be appealing to the Right wing.

- Elon even pushed his luck up to begging Trump to come back on the platform. (Which failed)

Guess what? All of this, so far, for nothing. The Red Wave didn’t happen. It has been postponed.

The dems more or less still retain control of the political landscape. Which makes Musk a character which isn’t exactly welcome anywhere (not even on his own social network) and increasingly distant from his own REAL money-making company, which isn’t Twitter but Tesla.

Tesla’s shareholders are going to lose confidence in the company if Musk doesn’t step aside and appoints a new CEO soon. Falling short of that, Musk should simply cut the crap and drop Twitter idiocy altogether.

Except, he can’t really afford to do that.

Because of Twitter?

Elon’s public persona is now tied to the fate of a failing asset: Twitter.

And Twitter is indeed showing all the signs of a failing franchise:

Musk played his character by the book, and pushed ego before common sense. He immediately got to the work of reducing the burn rate of the company by the most questionable methods: arbitrary head cuts which do not account for merit or strategy, and the push of unpopular workplace changes.

Elon is being the boss, therefore is going to face all the “boos“. The instant the workplace even hinted at turning slightly toxic, 90% of its most productive workers walked out. Everyone that worked in any competitive IT environment knows for a fact that the most productive individuals are constantly flooded with requests to switch company. It’s no big deal. Those people are the ones you want to retain at all costs, they know they don’t owe the company anything, and in this case they said bye-bye first.

Twitter is now stuck with the remaining assortment of workers, which includes the under-performers. Those who can’t realistically afford to land other high-paying jobs, and increasingly, with every uptick in workplace demands and toxicity, the selective pressure drives the best elements out. Which alienates the remaining workforce even more, in a cycle which amplifies itself.

Ultimately the company remains with mostly bozos on its payroll. The very thing the management wanted to avoid. We have seen this dynamic countless times.

And here is the problem:

Musk has bought Twitter by selling $TSLA shares and using shares collateral. If Twitter’s value decreases, Tesla is going to feel the heat. In a way, he is now captive of his own smartphone ramblings, holding a massive bag.

Overall I’d he’s done a very good job. Nicely done. Musk openly showed how giants fall: as soon as they forget they are fallible, they go down right away.

Now, about $TSLA:

In line with what I have been writing here, the name reabsorbed its 2021 bubble, checking in a 56% decline from the top, and is now sitting at the Nov 2020 floor.

The chart is oversold and due for a rebound, but the name has to earn it first!

On the press side, Tesla is attacked left and right. The videos and the news of vehicles catching fire or accelerating against ongoing traffic keep flocking in. Tesla is also under investigation from the DOJ because the autopilot keeps killing bystanders, occasionally, and all of this makes up for a very bad sentiment.

Due to the earnings, and the competition which is becoming stronger and stronger, the name is ultimately heading lower, but the time is ripe for an upside rebound before that happens. At this point, any piece of positive news could trigger short-covering.

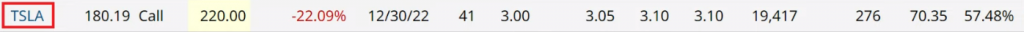

On Friday I followed this options trade:

Someone is committing 6M$ betting that the name is heading higher in the short term. Now, this contract (220) isn’t so out-of-the-money to look unrealistic. It’s an interesting event on the options market. Let’s see what happens next.

The big trade on Energy

I’ve been bullish on Energy since 2020. And most of my earnings so far have been in Energy.

But at some point the trade has to end: In a recession, Energy goes down.

Early signs of that happening have been shown by the energy names that underperformed compared to the average.

I sold some short-term calls during last week’s peak, to raise some money and to offset a potential retracement, which is happening. The money is in the bag, and most of those contracts are out-of-the-money. Worst case scenario, the uptrend resumes, and I will be selling some names when the contracts expire. It’s a win-win.

Overall, I remain bullish on Energy because there is just too much aggregate demand waiting to kick in. US Strategic Reserves will have to be replenished at some point, and the US and most of Europe are going to have problems with Diesel fuel shortages.

Furthermore, a new high for Natural Gas is just a very bad storm away. Mark my words: Natural Gas hasn’t done climbing.