A few things happened in the US market. Here is the Market recap for those, and for the close of the week.

Table of Contents

- Vitals

- Heatmap

- Options

- VIX is drunk. Go home, VIX.

- China “optimism”

- Midterms GOP “optimism”

- Inflation “optimism”

- Crude Oil’s dramatic comeback

- Trade scratchpad

Vitals

| US Dollar | Down BIG (-2.3%) | Bullish for equities, commodities |

| US 2-year notes | Unchanged, yields inching toward 5% | Bearish for equities |

| VIX | Closed the week at its lows (24) | Bullish for equities |

| Gold | UP BIG (3%) | Bearish for US Dollar |

| Crude Oil | UP BIG (5.6%) | I might have told you so |

- The FOMC meeting, with the most hawkish JPow we’ve ever seen, has been dismissed entirely by the market.

- The employment numbers were massaged to come out right, to make the current administration look good, but not hot enough to induce the market to dump and run.

- In response the market did exactly the thing that warrants more FED tightening, it transitioned to the Risk ON mode. (See the heatmap later)

The Risk ON is confirmed at least in the short term by a drastic drop in US Dollar coupled by the sharp rise in Gold valuations. This means in all likelihood that the US Dollar is going to drop for a while, and consequently equities and commodities are going to become more expensive.

The consequences are clearly visible for Crude Oil which scored big gains, although this requires a separate analysis (later).

Overall this is very bad news, as the current market conditions make up for a strong tailwind for inflation.

Heatmap

Pretty much everything in the green, but we clearly see the big tech scoring gains. For once.

This is what Risk ON means, and smells so much of early 2021.

Options

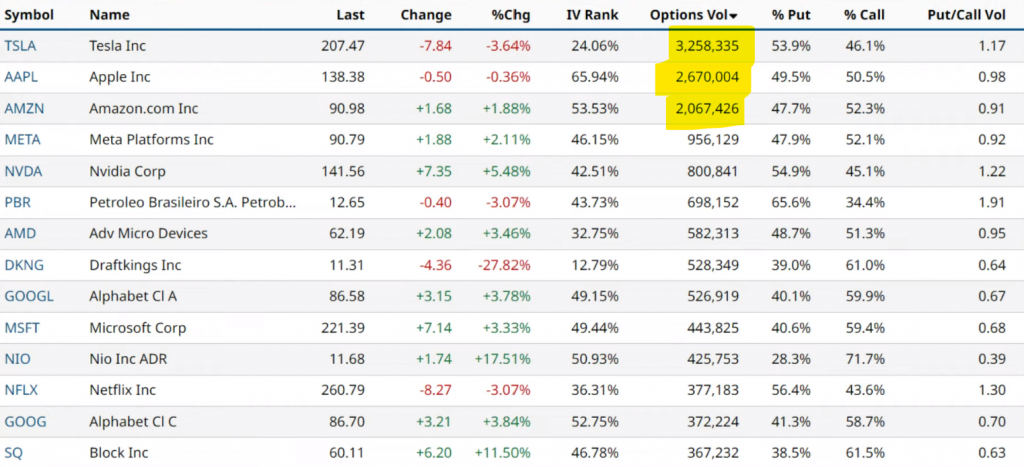

The participation continues, Tesla, Apple and Amazon continue being the hottest tables. We can see some CALL buying but not a decisive shift. Operators appear to be inching toward an optimism narrative. Bless them.

My hunch is that the bulk of the operators want to cash some performance bonuses at the end of the year, but so far the only thing they have to show are massive bags.

I see this market uptick as a sort of rebellion against this situation. They all went into let’s buy crap anyway mode. That is what has been triggering this commitment to drive the market up, nothing else.

Longs are gonna have a party ending with a massive rug pull.

I say OK. Wanna play this game? Let’s play the game.

VIX is drunk. Go home, VIX.

On Thursday, after the FOMC we saw the market fall, and yet the VIX wasn’t climbing. On the contrary, it proceeded to make new lows.

The VIX isn’t exactly a reverse proxy for equities. It, literally, is an indicator of volatility for the options traded against the S&P 500 Index.

During a market plunge, they weren’t that volatile. Why? Because operators weren’t buying PUTs. They weren’t hedging. Operators decided to play the long side, quite literally.

And lo and behold, the following day the market went up, and possibly staged the start of a reversal.

This is a massive, massive long signal, at least in the short term.

Why all this optimism all of a sudden, one might ask? There are several conspiring narratives at play. Let’s see them.

China “optimism”

A mysterious leak came from China where, allegedly, internal talks within the CCP are ongoing towards a plan to re-open the country, and end the damaging of the Zero-COVID policy.

Riveting, isn’t it?

The market decided to buy the news instantly. So not only Chinese stocks went up, but also all stocks with exposure to China:

- Nike up 8+%

- Texas Instruments up almost 4%

- Starbucks up almost 10%

- Teradyne up almost 10%

Guys, these are all fantastic SHORT opportunities. Why?

Because I trust no rumors from China, unless they have been immediately shut, and then fiercely denied by the China’s Communist Party.

Sacro

*tadaaa*

This leak has all the attributes to be a false flag operation. A rug pull, pump-and-dump scheme.

I don’t know who engineered this scam, and I don’t care.

My point is that you have to be an idiot to believe a chat screenshot, of unattributed sources, circulating in the country which has the most brutal and pervasive online censorship capabilities. But regardless, US market operators proceeded to sink almost half a trillion buying the news.

Grab the popcorns.

The 20th CCP Congress ended just last week, and Xi is emperor for life. Xi is a baby in an old man’s skin and he behaves as such. And the Zero-COVID policy is HIS policy. It is not going away anytime soon.

I’m shorting Alibaba and Starbucks for sure.

Midterms GOP “optimism”

Ah yes, the midterms. The market is already welcoming a change in the administration, cheering at the new overlords from the GOP.

Because they are going to be dovish? Will they force the FED to go print-baby-print once again? Unlikely. That’s not in their immediate power. And that isn’t necessarily what would be going to happen even if it was.

What the GOP is going to make instead, if given the opportunity, is reverse all those juicy Green Deal policies, and clamp down on Medicare and Medicaid, and FOR SURE slam down the gas pedal on carbon.

In recent history, the GOP has always been all about f*****g the people and the planet as much as possible, it’s kinda their thing.

So they are going to make the life cost more expensive for average people, and open the spigots for domestic oil producers, flush them with money and promise them a relaxation of the Green Deal deadlines.

What do you think OPEC+ is going to do about that? Exactly, more supply-side tightening.

Inflation “optimism”

I’m going full Nostradamus here, forgive me, but I’m calling a prediction.

There is going to be some new narrative, shortly, about “CPI Optimism”. At this point the shared will to score some gains by market participants is so strong that any CPI number, even a if showing a modest MoM deterioration, could be framed as bullish news. One can always find a fitting narrative. The sky is the limit here.

In other words, we are probably entering a “bad news is good news” mania cycle.

And inflation is of course not going down.

Merck came out with this fantastic report about the supply chain woes that are not even close to subsiding. The reasons are multiple: China shutdown, Ukraine conflict, etc.

This is going to tighten supply conditions even more, pushing prices higher on a global scale.

An on top of that, to propel Inflation numbers even more, there is Crude Oil.

Crude Oil’s dramatic comeback

As previously speculated, Oil is starting to respond to technical reasons, to the upside. It’s starting to take off again.

And this is only worsened by the US Dollar losing value due to all this optimism. It’s only going to make things worse for inflation, and this will in turn have the FED do things that will push US Dollar higher. Ultimately inducing a market capitulation.

But that is not all. The OPEC+ has placed a massive PUT on the price of oil. They know that the US government has backed itself into a corner, they consider the US an enemy on many fronts, and they are out for blood.

See, the US has strategically depleted its strategic oil stockpile. A cheap and temporary substitute for more supply.

There is a buyback program to refill it, starting at prices lower than 70$. (Therefore we are not going to see prices that low anytime soon. That’s for sure).

My bet is the buyback program will be revised to trigger buybacks at a higher price than that. Way higher.

Why? In the latest weeks the situation has worsened considerably. At the time of writing the US is managing a Diesel fuel shortage. Right ahead of the Christmas season, the yearly peak demand season.

Oil distillers are going to process crude as much as possible. What do you think is going to happen to global demand?

I’m staying long energy. Possibly even more so than before.

Trade scratchpad

- $MPC trade long at 50%

- $VLO long entered again at 128 (50%) 1st target at 144.5

- $ETSY appears to be drunk. Short via PUT with long expiration (2024)

- $BABA short (10%)

- $NKE short (10%)

- $SBUX short (10%)