Coming from part 1 of this series, we outlined what the real estate sector in China is like, and the problems that came with it. The hunt for safety and societal greed that allowed problems to scale out of control, and some specific facts about how giant Chinese builders turned themselves into the bomb hidden within the system.

Of all things in China, the real estate looked like the largest and most obvious ticking bomb. But it managed to stay afloat and perform splendidly so far, didn’t it?

It kept going on without stalling, ever. A machine that since the real estate reform in 1998, seemed unstoppable. We now know that that shouldn’t have been possible: the speculation was simply too high.

So why didn’t it crash sooner?

Well, history teaches us that all unstable conditions can go on for years or decades if left undisturbed. They nonchalantly persist for as long as no catalyst event comes to topple them. It’s illogical, I know.

Trader’s perspective of Complex Systems

It’s about time we get some tools to work with this phenomenon. This is supposed to be a blog that teaches stuff.

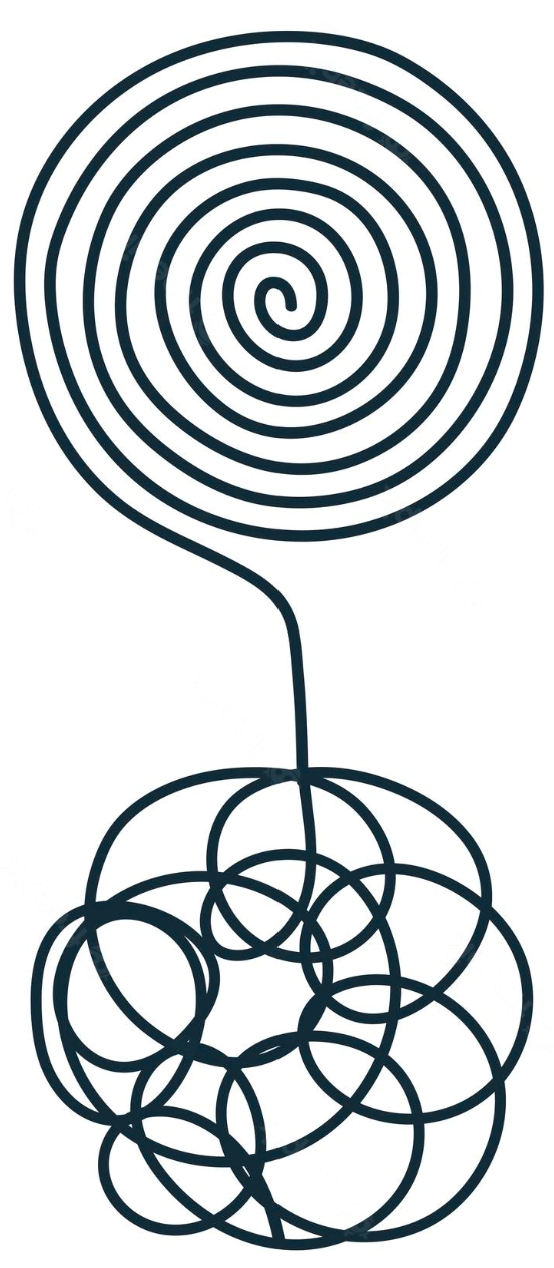

A system that persists living against all odds may often be something we call a Complex System.

What’s a Complex System? It is defined as a system that can only be described at a macroscopic level due to its internal chaotic component.

A modern car engine for example, which is mechanically very complex in nature, isn’t a Complex System at all; it is precisely engineered and completely understood down to the smallest screw.

A real estate market instead, our scenario, perfectly qualifies as a Complex System.

Some complex systems, for some reason, may also happen to be provably unsustainable at a fundamental level. Most are human in nature, or have the human component as their driving force: they work on the basis of countless and seemingly chaotic interactions.

These are the systems in focus for this digression. Why? Because they always display the same emergent, recurring, and oddly pernicious features.

You see, the thing with this subtype of systems is that despite their apparent instability and clear impossibility to even exist, they often can and will, simply keep going. They don’t autonomously devolve into chaos, which would be their natural terminal status.

Instead they might screak, they might totter, they might outright ignore any common sense and laugh in your face as they do so. For a long time.

They. Don’t. Care.

This is speculated to happen because people are overall protective of a system they are involved with.

But in truth this only persists until a catalyst event finally comes and crashes them. And as the time passes, the probability of any such event happening creeps toward 100%. Then, and only then, they devolve into chaotic systems.

No catalyst event → no trigger → no fatal imbalance → no chaos → no implosion.

And this is how civilizations fall, by the way.

Next time you are researching a market, and witness something that shouldn’t be possible or sustainable – something which instead stubbornly keeps existing – then check if you find yourself in the position to time its future transition toward a more chaotic state.

This is your primary obligation if you happen to be a position trader.

But by now China’s real estate market, as a complex system, has been unsustainable for a very, very long time. I wonder what happens next?

COVID-19

At the beginning of 2020 the entire world, literally, grinds to a halt.

Yeah I’d call that a pretty good catalyst event all right.

While the world copes with this new pandemic reality and every continent goes through its own series of hits and misses, the CCP instead puts up this display of China being the country that just has the attitude to shrug it off.

This play, which is CCP’s face-saving narrative and therefore their main priority, of course soon transitions from being an enviable display of soft power, into outright parody. Then, while the rest of the world attempts to move on and throw the problem in the past, in China, Zero-COVID, massive doorstep lockdowns, and a number of other draconian policies are introduced.

All of this of course is a pointless exercise in extreme control of personal freedom, which was dragged to a new low. But regardless, the country’s economic output predictably tanked with it.

And just like that, the CCP boldly proceeded to throw a wrench into China’s own growth engine.

That’ll teach ya, world!

China’s ruling elite, 2021

Here is the catch: unsustainable systems entail so called non-local, “side” effects.

They subsist at the expense of any other adjacent system. They are unsustainable, so they will deplete all available energy, and therefore they will keep running on a negative energy budget, leeching resources off of others.

They will deplete any safety margin, then they will keep running with no safety net whatsoever, becoming a hidden danger.

The rationale is that the longer they run:

- the bigger is the energy deficit that they accrue

- the larger is the structural damage that they cause to all nearby systems (Excessive debt)

- the smaller a catalyst event needs to be in order to push them beyond what is called the recovery domain (Excessive leverage)

This in turn pushes adjacent systems into unsustainability too, setting things up for a runaway effect. Like domino tiles.

Unforeseen liquidity squeeze

As we mentioned previously, property developers in China have established a cash model that departs on the assumption that people will pay in advance for house units that will be developed far in the future, and that these units will ultimately always materialize a gain when sold. This made those businesses entirely forward-paying and prone to an ever-expanding work backlog.

Therefore, highly leveraged. And indebted on a big, truly massive scale.

This has proved to work well during the high-growth decades. But in a post-COVID economy, seeing things turn for the worse, and I really mean every single thing, the CCP must have started to feel some heat.

In 2020, cooking the next batch of numbers according to the world’s expectations was becoming impossible for them, and at that point awareness of sitting on a massive bubble ready to pop must have been spreading in CCP’s inner circles for a while.

“What’s with all this money grabbing from property developers anyway?”

CCP’s leadership must have thought it was time to stop it. If the stealing isn’t led by them, then what’s the point of being the leadership right?

After all, China, being a communist country is supposed to loathe capitalism. (How ironic).

Well, this called for some regulations, deleveraging, squishing away some greed, some more control, and a public restoration of decorum. Something had to be done. And thus the institution of the Three Red Lines policy was put forward. Its intended effects came right away, and property developers saw their liquidity vanish immediately.

Real estate builder’s criminally inflated valuations… they came back to bite them in the ass, apparently, because cash has been choked out of the real estate sector in a much much bigger proportion than anticipated. And that was the tipping point when the first domino tile started to come down. Evergrande being of course just the tip of the iceberg.

With basically zero cash to their name, property developers halted all construction. Every further chunk of liquidity from sales was then redirected to servicing their outstanding debt. Which is huge, as we mentioned, if compared with the real, uncooked size of their balance sheet.

Developers found themselves in a spot so tight that they started to accept non-monetary payments. It got as far as forcing them to accept fresh produce instead of money. I hope they do love garlic as much as I do, because sure they have got a whole lot of it now.

And this poses a new problem: It freezes indefinitely the construction of already sold units, cementing the size of the construction works backlog already accrued (no pun intended).

If you are one of the paying owners who have been waiting to see their home built, that is the last thing you want to see. And this is where I start to feel for them.

No, sorry. Change of plans. I will be doing that in part 3 of this series.