I’ve been busy and away from the keyboard for some time. Sorry about that.

During the time that I was away, countless new market developments happened. Did you notice? One of the last bastions keeping up the market has started to fall: it’s Apple ($AAPL).

What does that signal us? The institutions are starting to lose their grip. They are seeeelliiing baby!

Apple is primarily an institutional name. Directly or indirectly, it shows up as the largest slice in all generalist ETFs, which in turn means that it is largely held by pension funds and institutions.

Apple falling is a sign of further market degradation to come.

After Apple, who else is left standing?

It’s none other than the stronghold of retail investors: Tesla. ($TSLA)

Retail investors always sell late, and they always lose. So let’s look at Tesla. It could make up for a great trade opportunity.

| Asset | Primary bagholders |

|---|---|

| $AAPL | Institutional resiliency |

| $TSLA | Retail investor’s resiliency |

and the base assumption in this analysis.

A cult we have seen before

Tesla is a cult-like stock. Shorting Tesla is frowned upon. It’s a name which enjoys a special status that has overreaching effects. It goes way beyond the insane valuation of the company itself. This is a (transitory!) phenomenon which we have already seen before, with other names.

History is ripe with examples here: Firms that went through this phase were IBM, Cisco, Microsoft. Then it was the turn for Apple. And Bitcoin has seen that too (repeatedly).

All of these names have been repriced one way or the other. And all of them have produced sharp downside corrections in a time of crisis.

This time we are going to see the same with Tesla. A stock whose max historical market cap is one trillion US Dollars. All in a single stock! It’s an insane capitalization. Deflating this monstrosity will not simply hurt the portfolio for a lot of people. We are talking major effects on the economy as a whole.

But so far Tesla has held ground better than basically any other mega-cap because it is mainly a retail-backed stock, and because retail capitulation hasn’t happened.

Yet.

Retailer investors are HODLing the name.

Very well, so let’s discuss their case first.

The bullish case

For starters, Tesla Model Y and Model 3 are leading the EV sales in US. And by a wide margin too.

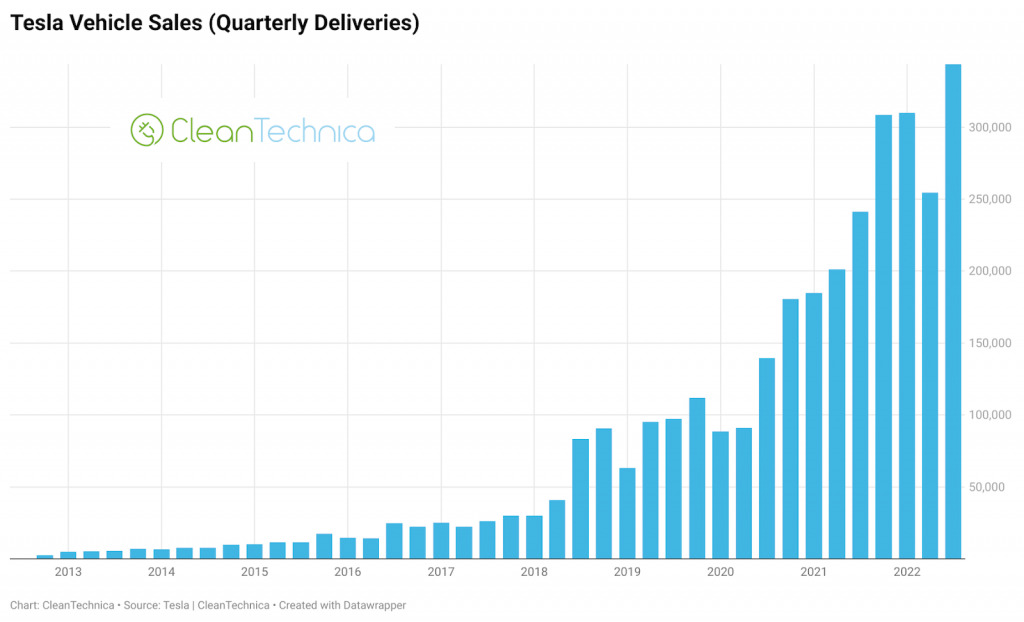

The name has achieved astounding growth during the pandemic. For the US market, it comes as the absolute first, primarily fuelled by the shift in momentum toward EVs. It’s like if during the pandemic, EVs were the only sales happening.

For this reason, Tesla has worked as a good inflation hedge so far. They retain the pricing power to pass down increasing prices to the customer, because of its cult-like following, and because the customer base – overall – feels that the asset is still worth the price. This is confirmed that deliveries that keep growing, and demand that isn’t abating.

Due to the strong demand, and in order to offset the increasing production costs, the company has been able to perform repeated price upticks in all of the company line-up, from Model 3 up to the flagship models. Apparently, with no ill effects on sales.

The cheapest Tesla option today retails for about 47000 US$. Prices are going through the roof, and yet demand is still sky-high.

These fundamentals, and most importantly the assumption of their continuation, are what prompts the market to buy Tesla at every opportunity.

Not immune to recession.

Let’s discuss the other side of this truth, shall we?

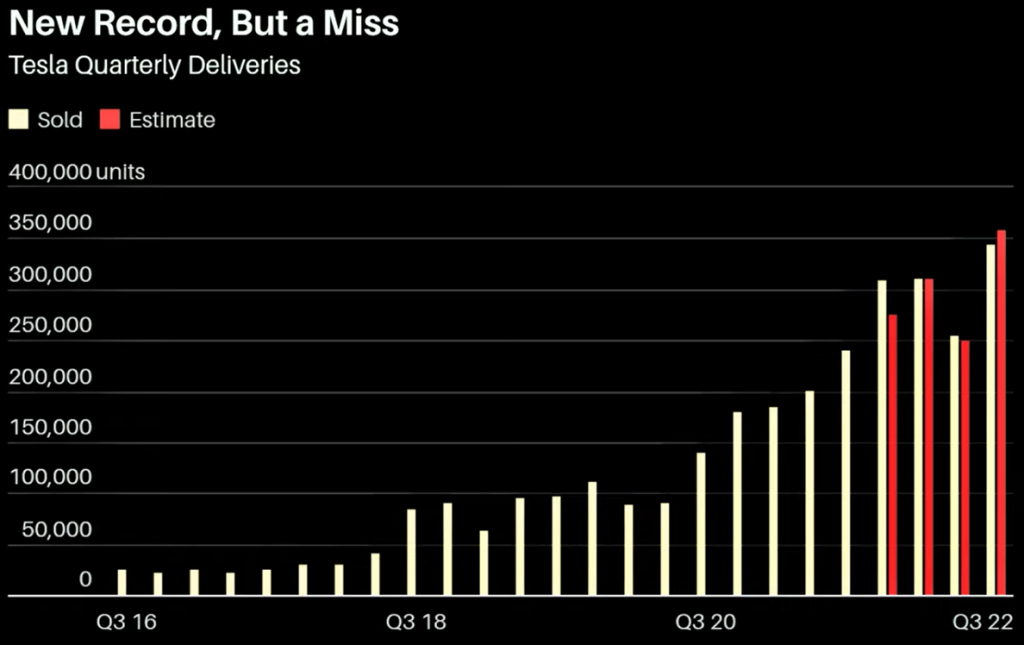

This last quarter, Tesla deliveries set a new record, but something new shows up in the numbers. Delivery expectations were missed for the first time.

What could this mean?

It may mean that peak growth for the name has been achieved.

Tesla is now facing increasing competition from other firms that are quickly catching up, and a swift dissolution of the strength of its customer base. This is bad news for the name, and can only get worse.

Let’s look at the customer base. Who are these people?

Well, Tesla sells their cars mainly to two clusters.

- Rent and car sharing businesses

- End users (retail)

For everything that is car rental and car sharing, we are entering a major downturn. All these companies care about is the profit-per-vehicle profile of their purchases. Tesla vehicles are now just too expensive while their customers are being hurt by the ongoing crisis. Leisure spending is going to go down, and so will do the earnings of these companies. Their books are now filled to the brim with Tesla vehicles that are aging, and that aren’t able to churn out money like they did in 2020-2021. On this side of the market, the money tap for Tesla is now closing.

And then there are the end actual end users. These are what has been driving up the remaining demand so far. But who are these people? Who are the typical buyers of Tesla vehicles?

Excluding high net-worth individuals, which are a minority, we are talking primarily about white collar jobs.

And the next wave of layoffs is all about them. This is the category of workers that most benefited from the liquidity expansion during 2020-2021, and now that the opposite dynamic is taking hold, this will be the category of workers to pay the largest price. Do you think they will keep shelling out money for an overpriced car?

My money is on them actually selling their Tesla to get some money back instead!

However, my assumption is that the next recession will cut through white collar positions like a hot knife through butter. These are the job positions that have grown the most during the pandemic, due to the insane money spending of the tech firms.

Now that the tide is flipping, a large portion of these positions will be made redundant.

And with them, in a tech recession, there it goes Tesla’s price advantage.

It’s lost. Completely.

Oversupply.

Tesla aligned its production capacity to the outlook of an ever-growing demand. Something that isn’t a realistic scenario, and in the short and medium term is expected to cause a bad backlash.

Why?

Ride sharing services splurged on Tesla vehicles, but are now going to halt purchases.

Same goes for car renting.

And let’s also mention the phenomenon of Testa flipping, which has now reached a ridiculous stage. Average people keep buying Teslas at a premium, to get them faster, only to flip them immediately for a profit.

All of this is bubble dynamic in action. It increases demand for Tesla vehicles by making the asset difficult to source and hard to come by. Regular people who aren’t participating in the stampede, who simply wanted to own the car sometime in the future but are in no rush (a considerable amount of future sales) will simply reconsider their choice as soon as the job market starts to shake.

All of these people make up for a large number of missed sales that won’t materialize for a long time.

Guest what? This will cause oversupply. Demand will transition from excessive to disappointing in mere months.

It’s a mini-bubble. As soon as the perceived value of the asset goes down (i.e the demand), the bubble starts to deflate.

Inventory bomb

Driven by excessive demand, Tesla stockpiled lithium carbonate at the highest prices in history. And this is true for chips, copper and nickel too. The company paid for a wildly overpriced inventory on the assumption that customer demand would continue to rise, opening a window to pass down the increased costs to the customers.

As soon as the cost of these commodities starts to really fall (and this will happen as a consequence of the next crisis), the company’s valuation will suffer. Basically Tesla has locked-in the loss. The existing inventory obviously can’t be repriced down.

The firm faces the possibility of selling vehicles at a loss in the near future.

Foreign market

On top of this, let’s add the fact that Tesla vehicles are priced in USD, which is just too strong against the Euro area. Foreign customers are facing a 28% price hike (compared to 2021) which is simply caused by the relative fall in value of their currency. And this, on top of the existing price hikes from the company itself.

In their latest investor’s update, Tesla didn’t disclose geographical sales. But I’m doing that for them: just go to Sweden or Norway. This summer, about one in three cars on the highway was a Tesla.

As a matter of fact, the market now feels a little saturated.

Autopilot bomb

Musk has been acting like a ridiculous buffoon for some time now. We are starting to see through his character.

He isn’t an insane 4th-dimensional chess player. No, he’s just insane.

Among the undeliverable and/or underwhelming promises that he made, other than the royally botched Twitter deal, the fart tunnels, the Cybertruck, the bipedal robot which does nothing, Mars, the Neuralink interface which does nothing, there is also the age-old Autopilot functionality.

Yep. It’s still a thing. And Tesla hasn’t really delivered yet.

A great deal of the forward-paying company valuation is stacked against this specific asset.

Should Tesla succeed in being the first company to own a legally approved self-driving technology, that would be huge. It would open a 3-to-5 years window of opportunity for the company to raise more business avenues, before the competitors would finally catch up.

But the Autopilot component is now facing its biggest challenge: lawsuits and legal groundwork.

Any lawsuit and consequent setback in the development and roll-out of this feature, which has been pre-sold and pre-enabled in a limited form to a large number of vehicles, will shake the company’s valuation to the downside violently.

This battle is just now heating up. The years ahead are a promise of more fun to come.

This asset is clearly a regulation risk, but being largely discounted in the current company’s valuation, it makes the asset extremely risky.

Media momentum is shifting

We are seeing media articles with increasing levels of criticism toward Tesla. This has been clearly a trend since 2022. Precisely, since Elon has proved to be an unreliable character, even before the Twitter s**tshow.

Due to its political stance and repeated attacks toward the establishment, Elon accrued a lot of angst against him and his firm. Government insiders dumped the stock at its peak, so they now don’t have any incentive in keeping a positive spin for the media narrative. And we can clearly see the effects.

On the other side, there is another media trend which is mounting.

Institutional investors with a lot of stake in the name are hurting, and are trying to prop up valuations in order to offload their package to unsuspecting investors.

Here’s an example:

Who is this guy? Here, I’ll tell you:

A massive Tesla bagholder, that’s who he is.

This media trend can only be interpreted as a contrarian indicator. A massive one.

On top of that, distress signals are coming from Musk himself. The guy (who has diligently sold at the peak a great deal of shares) started to look, I don’t want to say it, but to me he sounds a little desperate.

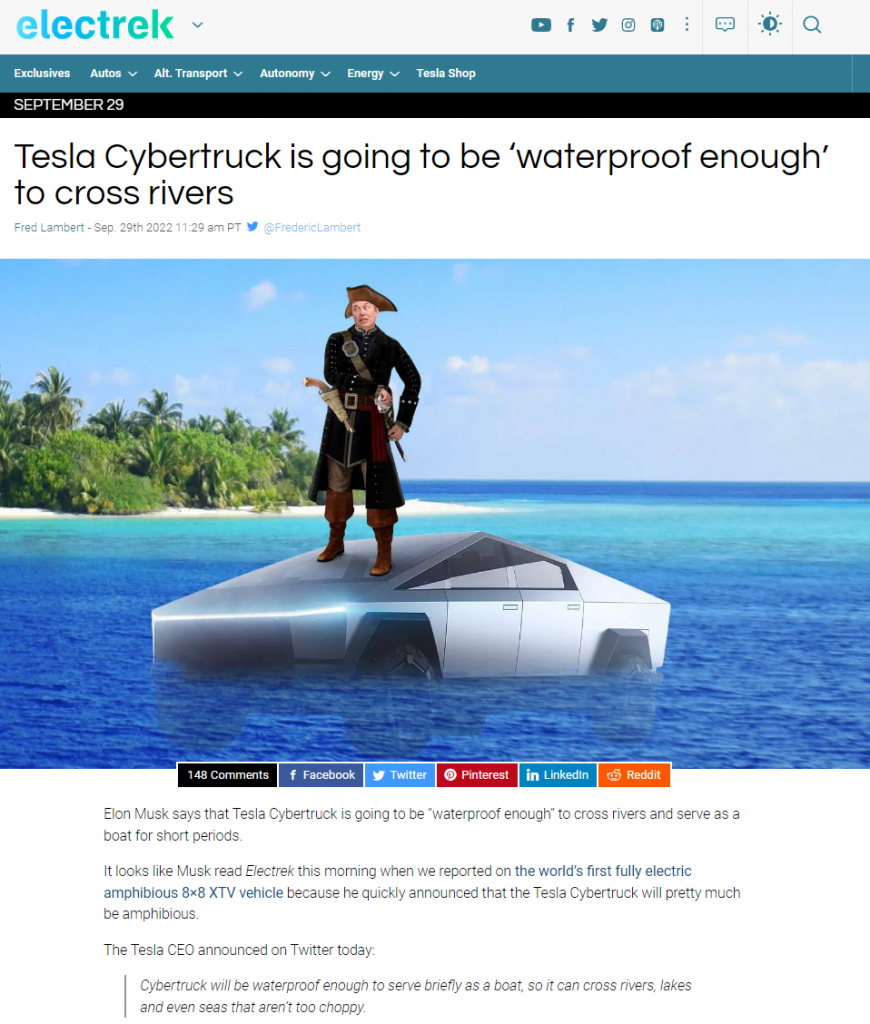

For example, in the context of the Cybertruck presentation Musk said that apparently now the vehicle has amphibious travel capabilities.

I wish I was making this up. But no. Here:

That’s a weird one. Especially if you look at the other side of the coin. Tesla employees who worked on the project are left puzzled by Elon’s remarks.

Stay tuned for an update with some technicals and a trade plan!